Proprietary Reverse Mortgage loans

Specific loan providers give exclusive reverse mortgage loans targeted at property owners who wish to locate funds https://clickcashadvance.com/installment-loans-fl/memphis/ getting large-really worth belongings. If you find yourself these types of financing are not subject to statutes that control HECMs, very lenders will follow and offer an equivalent individual defenses, that have required guidance are an integral part of the fresh new package. While the lenders constantly render such mortgages on the belongings one to well worth from the $one million or even more, talking about all of them while the jumbo contrary mortgage loans is quite prominent.

Single-Objective Reverse Mortgages

Single-purpose contrary mortgage loans given by specific state and local governments need that you use the newest continues you receive through the financing to possess certain aim like using possessions taxation or creating repairs. These types of mortgage loans are usually to have lowest- to modest-money homeowners. Particularly proprietary contrary mortgage loans, speaking of perhaps not FHA-insured.

How does a contrary Home loan Really works?

Regardless of if you paid off the majority of your mortgage and very own 100% equity of your property, there’s little chance that you may possibly be able to acquire as the much as their appraised well worth. Extent you can obtain relies on some products on top of that to your home’s appraised worthy of. These are generally age the fresh youngest debtor on application, this new HECM financial restriction, and current interest rates. Getting 2023, the newest HECM financial maximum really stands at the $step one,089,300.

Consumers constantly receive highest mortgage numbers while they get older, and you can low interest together with enjoy a great part in the number it is possible to discovered. At exactly the same time, your ount by way of a variable-rates reverse mortgage when compared to a fixed-price option.

If you decide for a fixed-speed HECM, you obtain an individual swelling-sum fee. Which have changeable-price HECMs, you could potentially have the funds in a different way.

- Located equal monthly installments if the one or more of one’s borrowers spends our home since his/their own number one quarters.

- Located equivalent monthly obligations to possess a fixed period of time.

- Get access to a personal line of credit you to operates until you maximum it out.

- Discover equivalent monthly installments and also entry to a type of borrowing if you don’t continue located in your house.

- Receive equivalent monthly obligations while having accessibility a line of borrowing to have a predetermined time.

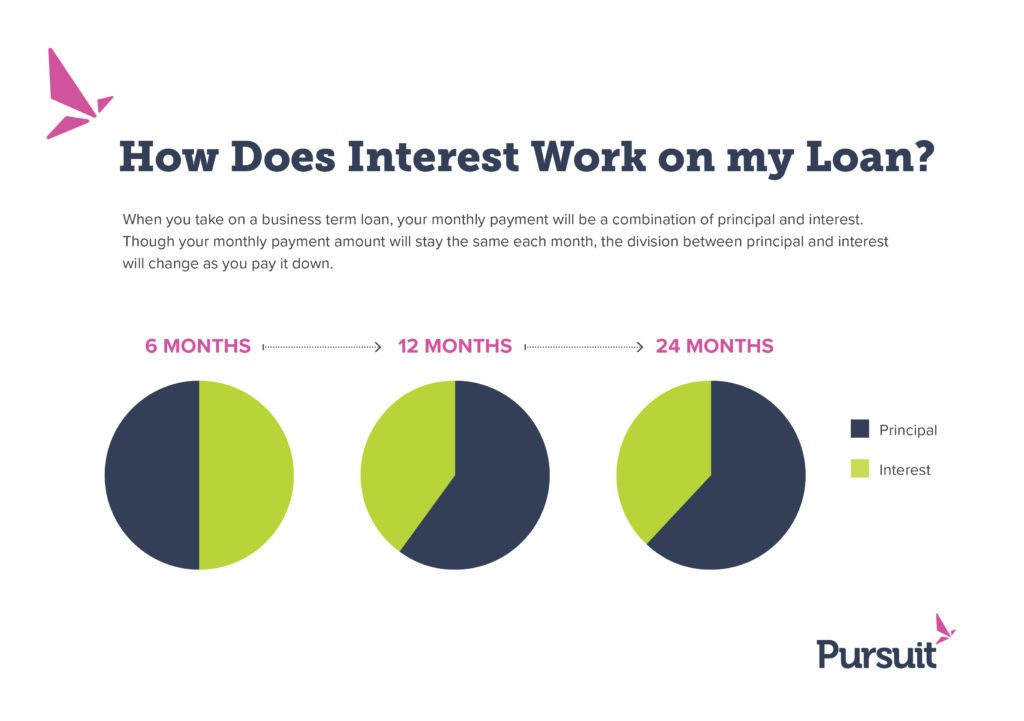

Like a consistent home loan , appeal on a face-to-face home loan has accruing per month. While doing so, you also need so you’re able to take into account the bucks you will have to cover ongoing restoration will set you back, homeowner’s insurance, and you may property taxes.

The elderly might imagine on the purchasing an alternative domestic of the considering exactly what good HECM for sale financial has to offer. In such a case, you have made this new freedom to determine how much cash you want to invest per month, with perhaps not needing to make any payments plus getting an option.

The three-Big date Right to Cancel

Extremely contrary financial enterprises provide the right to cancel the newest agreement within this around three business days of the loan’s closure instead incurring people punishment. If you wish to utilize this directly to rescission, you will want to alert your own lender in writing. This is why, it’s a good idea one to send your own termination find by specialized post and contain the go back receipt. Because bank receives your own find, it becomes 20 months to return any money you’ve probably paid in the type of charges or costs.

Bringing a face-to-face home loan comes with the share regarding you can easily experts and drawbacks. For example, whenever you are having trouble fulfilling your financial loans, an opposite mortgage is an approach to secure the future. But not, acquiring one isnt free and comes with individuals fees and you may costs.

- You may want to remain surviving in your home in place of attempting to sell they to obtain the currency you prefer.