Ideal homeowner loans

For many who very own your own house a resident financing out-of Pegasus Fund could be the most readily useful financing solution to suit your need. Most loan providers will check owners of a house really an excellent white while they commonly display screen most useful money handling enjoy and they are commonly a much safer choice.

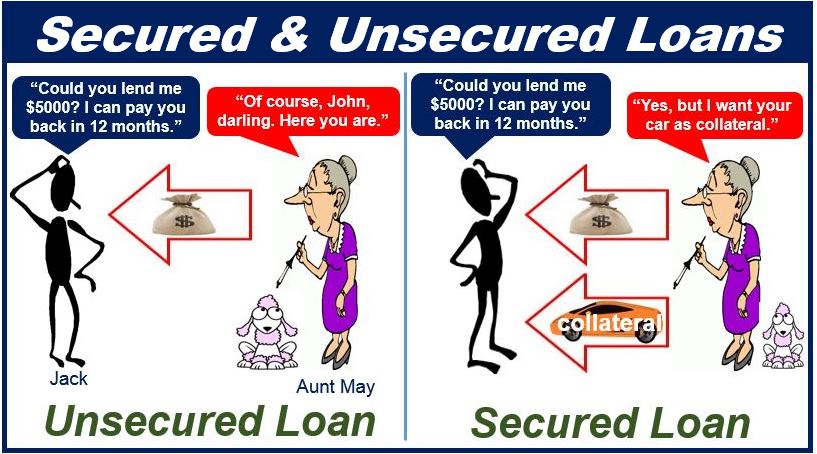

An effective Pegasus homeowner mortgage would be sometimes covered at your residence otherwise unsecured, based your circumstances, requirements and personal tastes you’ll find pros and cons to each and every.

What is a protected Mortgage?

Secure homeowner money are available to you if the home is mortgaged or owned downright, talking about often called 2nd fees loans. If you do have a mortgage on your own household the lender need to remember that your home features a great security we.age. its market value is worth more than the fresh an excellent home loan harmony.

Terms having covered homeowner financing would be spread-over as long due to the fact three decades, that’ll reduce the payment significantly however, will cost you more when you look at the attention charge over the life of the loan.

Rates of interest which have protected homeowner financing are usually lower than unsecured fund since the financial has the defense of your property would be to your are not able to result in the payments.

However, we have several lenders which promote preferential prices so you’re able to people looking signature loans as large as ?50,000. Unsecured homeowner loans are generally less to prepare and will getting spread over terms of to eight ages.

Spends Out-of A citizen Financing?

This form can be used for almost any goal. Whether need the money getting renovations, marriage, a unique holiday or for paying most other debts, we are able to give you the money that you need.

How much do i need to acquire?

We provide financing to possess property owners regarding ranging from ?5,000 and ?1 million. Maximum amount borrowed depends on multiple factors along with;

- Your revenue

- The https://simplycashadvance.net/payday-loans-mo/ latest equity of your house

- Your credit history

- The mortgage cost name that you require

Loan Professionals

- Rates of interest from 5.9% Annual percentage rate

- Borrow away from ?5,000 so you’re able to ?one million

- Pay back the mortgage over dos so you can three decades

- Pick secure or personal loans

- Use financing for any goal

The mortgage calculator in this post offers a crude concept of monthly payments, but a better suggestion is to make an application and you can assist united states find a very good homeowner finance offered before generally making up the head. There’s no duty and most lenders only generate a beneficial silky search on your credit history to be able to give your an in-idea decision.

Interest levels getting normally fixed towards reduced identity loans and the longer term shielded next costs finance are often adjustable immediately following a primary months.

If you are looking so you’re able to hold the financing facing your residence the lenders can charge valuation or judge charge, but all this could be explained to you plus attention rates costs and you can monthly premiums before you could invest in taking one loan.

Caution Protected Homeowner Money Your house Will be REPOSSESSED If you do not Carry on with With Money For your Obligations Protected Inside

For top interest levels a great credit history create feel useful however, even with less than perfect credit record you could potentially however score a competitive and affordable bad credit citizen mortgage having Pegasus Fund.

I work on loan providers just who look at property owners favorably, specifically if you are prepared to contain the loan on the possessions. We and additionally keep in mind that perhaps not everyone’s cash work at efficiently and as a lot of time as you’re able to inform you the fresh mortgage are affordable there is a great possibility we could nevertheless help you.

How can i use?

Simply over the brief on the internet application form and we will rating straight to function to you personally. Instead, should you wish to mention one thing very first you can call us free for the 0800 066 2882.

Next, a skilled Pegasus Funds mortgage advisor often evaluate the job and you may your conditions before presenting your situation on the financial exactly who they think might be to help you and provide brand new best homeowner financing alternative offered, every for free to you.

When we have the best give completely approved, your advisor usually contact one give an explanation for bring in more detail and also to show you before area out-of payout will be your be happy.

It is the advisor’s employment for the very best citizen loan possible in place for your requirements but if you refuse to feel happier into provide by any means there is no further duty or one charge recharged from the all of us.