If you’re there are no strict restrictions how often you might refinance , performing this too frequently normally sustain costs and will cost you one provide more benefits than the pros. While the a broad guideline, most of the dos-five years try a reasonable timeframe to take on refinancing in case the numbers make sense centered on your situation.

The price of refinancing a mortgage in australia may vary created on the several issues, but check out prominent fees you could potentially come across:

- Software payment: Commission recharged of the bank just for control your re-finance app

- Assessment commission: $600 so you’re able to $dos,000 to obtain the property’s value assessed

- Attorney charges: Charge to have judge report about papers (varies by condition/territory)

- Identity browse and you may loan providers financial insurance coverage: 0.5% to at least one% regarding worth of

- Origination fees: 0.5% to 1% of your own loan amount paid down to help you lender

- Registration costs: Getting switching loan providers

- Property valuation percentage

Refinancing around australia could cost dos-5% upfront. No-closing-pricing choices hunt attractive, however, often feature a somewhat higher interest rate, potentially increasing your payment per month. Although not, they are of use when you are secured for the money initial.

Consider carefully your situation and you can compare overall mortgage will cost you (focus + fees) for both choices over the financing label. Speak with all of our large financial company to assist find yourself an educated refinance bargain.

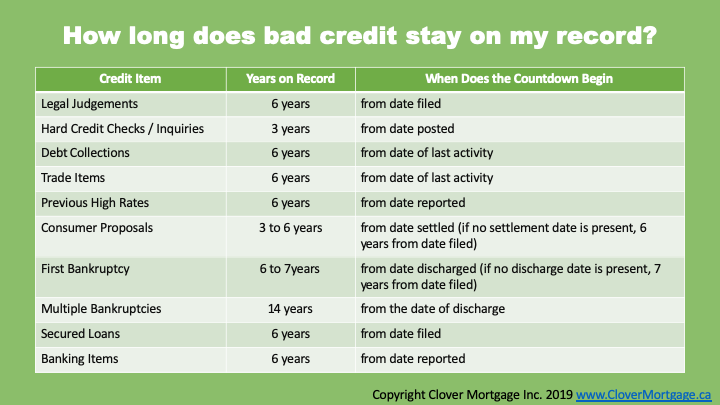

Refinancing your residence loan wouldn’t damage the borrowing, as the application alone makes a hard inquiry on your own credit report. A hard query will get lower your credit score a bit. This will only render an awful effect on your refinancing application in case the get try borderline between are ok and you will a beneficial.

Although not, and make several difficult concerns contained in this a short while physique make a difference your credit score. Picking out the properties out-of a professional large financial company decreases the chance regarding multiple hard questions happening due to the procedure i fool around with.

Simply how much Equity Would you like to Refinance?

Really lenders in australia fundamentally require you to has actually about 20% guarantee remaining after the the fresh loan amount in order to refinance and you may borrow even more cash out of your house’s collateral.

Such, whether your home is currently valued at $five hundred,000 and your kept mortgage harmony is $three hundred,000, you really have $200,000 for the guarantee (40% equity). Of many loan providers would allow one refinance and take aside upwards to help you $100,000 of these guarantee inside the cash.

Your new amount borrowed is private student college loan $eight hundred,000 after the bucks-away refinance contained in this condition. When you find yourself delivering cash-out grows your own mortgage equilibrium and you will monthly payments, you might still be able to safe a reduced interest rate or shorter left mortgage name whenever refinancing.

Credit facing their equity will bring independency to make use of that money having home improvements, assets, to shop for an alternative assets, or any other high expenditures. Only keep in mind your instalments will increase which have a higher amount borrowed.

Loan providers and additionally usually charge quite high interest rates, to 0.5-1% over basic rates, for money-out re-finance loans because of the large loan-to-well worth ratio.

Can you Acquire So much more After you Refinance?

You could just take it bucks from your own home guarantee so you can remodel or extend your house. Or perhaps you need it another home and require cash to the a deposit?

Obviously, after you acquire additional money, your repayments increases. Good re-finance financial you may still reach a lowered rate of interest and faster mortgage name, yet not, despite enhancing the amount borrowed.

No matter what reason, Odin Financial can help you safe a good bucks-away refinance loan and you may enable you to availableness Your money!

Need assistance Refinancing Your property Mortgage?

Odin Mortgage simplifies refinancing having Australian expats by offering a led, expert-backed process to save you money and you can accessibility the equity, letting you use it to your financial requires.